Seasonal Financial Planning: Preparing for Economic Changes in South Florida

Understanding South Florida's Economic Landscape

South Florida's economy is as dynamic as its tropical climate. With a diverse blend of industries such as tourism, real estate, and agriculture, the region is uniquely positioned for both opportunities and challenges. For residents and business owners, understanding these economic shifts is crucial for effective financial planning.

Seasonal changes, including the tourist influx and hurricane season, significantly impact the local economy. Preparing for these variations is essential to maintaining financial stability throughout the year. By aligning your financial strategy with South Florida's economic cycles, you can better manage your resources and capitalize on growth opportunities.

Adapting to Seasonal Tourism Trends

Tourism is a major driver of South Florida's economy, with peak seasons bringing a surge of visitors and economic activity. Preparing for these periods can maximize your financial outcomes. Businesses should consider hiring additional staff and increasing inventory to meet higher demand.

For individuals, the tourism season may present opportunities for temporary work or investment in short-term rental properties. However, it's important to plan for the quieter months by saving during peak times to cover potential income gaps later in the year.

Strategies for Businesses

- Increase marketing efforts to attract tourists.

- Adjust staffing and inventory levels.

- Explore partnerships with local tourism boards.

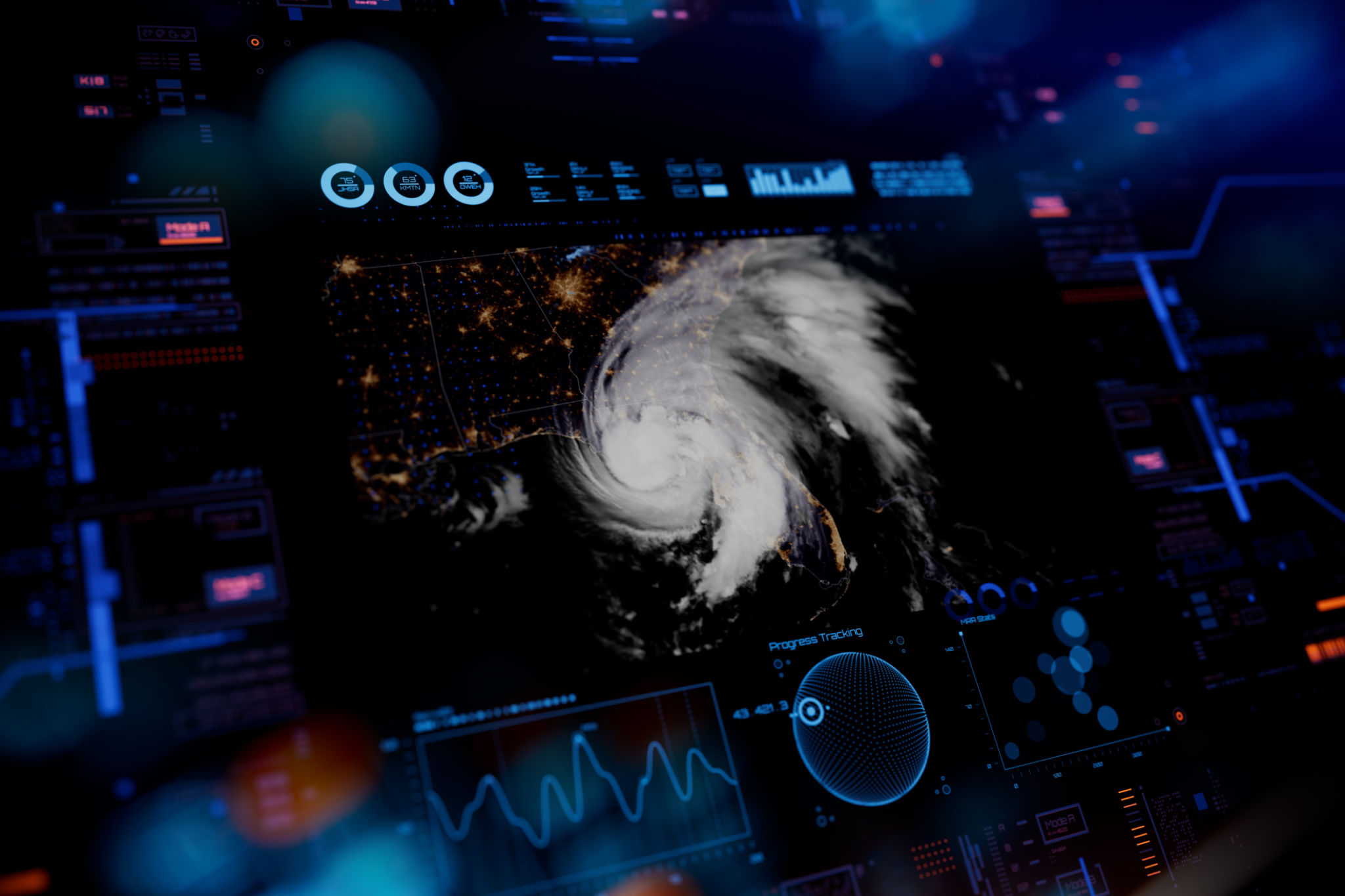

Preparing for Hurricane Season

Hurricane season is an inevitable part of life in South Florida. From June to November, residents and businesses must be prepared for potential disruptions. Financial planning for this period involves safeguarding assets and ensuring adequate insurance coverage.

Review your insurance policies to confirm they cover potential hurricane damage. Additionally, establishing an emergency fund can provide a financial cushion in case of unexpected expenses or income loss due to storms.

Steps to Protect Your Finances

- Review and update insurance policies.

- Build an emergency savings fund.

- Create a disaster recovery plan for your business.

Leveraging Real Estate Opportunities

Real estate remains a cornerstone of South Florida's economy. With fluctuating property values and interest rates, it's crucial to stay informed about market trends. Whether you're buying, selling, or investing, aligning your financial strategy with market conditions can yield significant returns.

Consider consulting with a real estate expert to understand the best times to buy or sell. Additionally, evaluate your current property holdings to ensure they align with your long-term financial goals.

Key Real Estate Considerations

- Monitor interest rate changes.

- Stay informed about local zoning laws and developments.

- Assess property values and investment potential.

Conclusion: Planning for a Prosperous Future

Financial planning in South Florida requires a proactive approach to navigate the region's unique economic cycles. By understanding seasonal trends and preparing for potential challenges, you can enhance your financial resilience and seize opportunities for growth.

Whether you're a resident or a business owner, taking strategic steps now will ensure you are well-equipped to adapt to economic changes and thrive in South Florida's vibrant environment.